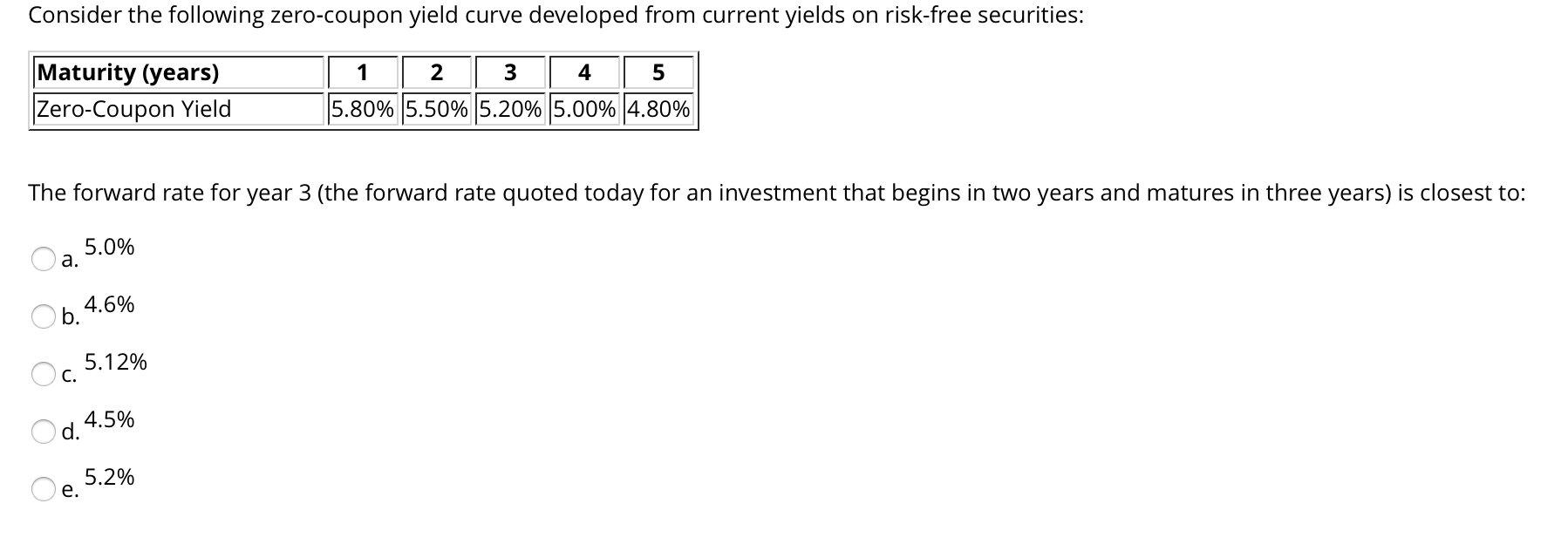

40 yield to maturity of zero coupon bond

A zero coupon bond has a yield to maturity of 12 and a par ... A zero coupon bond has a yield to maturity of 12 and. 102. A zero-coupon bond has a yield to maturity of 12% and a par value of $1,000. If the bond matures in 18 years, the bond should sell for a price of _______ today. A.422.41 B.$501.87 C.$513.16 D.$130.04 E.None of these is correct. $1,000/ (1.12)18= $130.04. What Is a Zero Coupon Yield Curve? (with picture) The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different ...

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate.

Yield to maturity of zero coupon bond

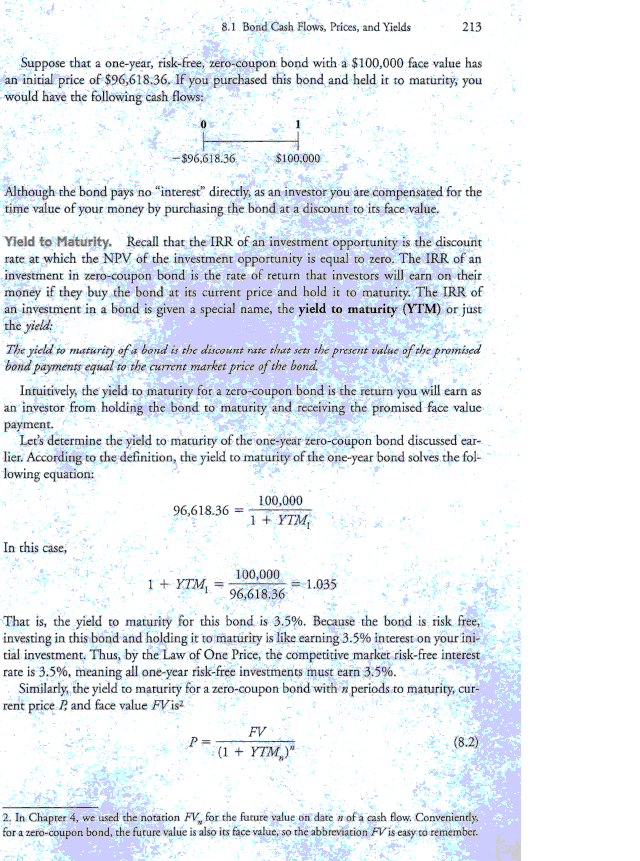

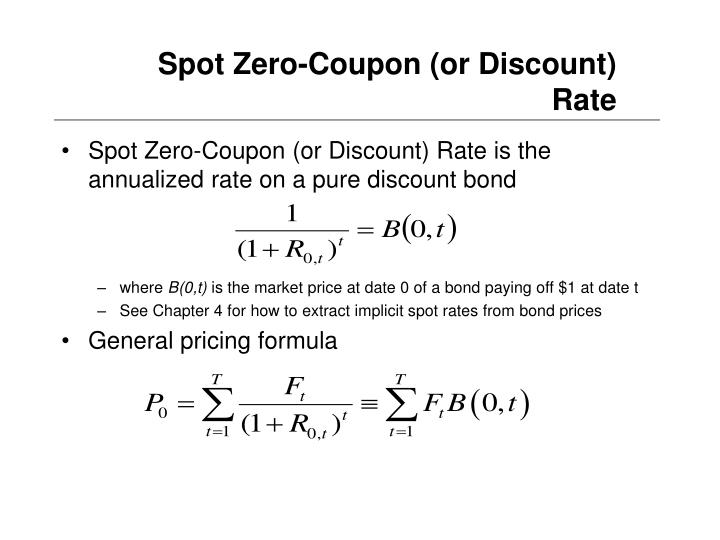

zeroyield - lost-contact.mit.edu In other words, if the zero-coupon computed with this yield is used to discount the reference bond, the value of that reference bond will be equal its price. Yield is a column vector containing a bond-equivalent yield for each zero-coupon instrument. When the maturity date is fewer than 182 days away and the basis is actual/365, the function ... Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Yield to Maturity - YTM vs. Spot Rate. What's the Difference? Spot Rate= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 The formula for the spot rate given above only applies to zero-coupon bonds. Consider a $1,000 zero-coupon bond that has two...

Yield to maturity of zero coupon bond. Zero Coupon Yield Curves Technical Documentation Bis 29, 2021 · Technical Analysis Risk Management It is also possible for a corporation to issue a zero-coupon bond, whose current yield is zero and whose yield to maturity is solely a function of the built Bootstrapping spot rates or zero coupon interest rates works as follows. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. 10 The yield to maturity of a 5 year risk free zero coupon ... 14) The current zero-coupon yield curve for risk-free bonds is shown above. What is the risk-free interest rate on a 3-year maturity? A) 3.00% B) 3.15% C) 3.25% D) 6.34% E) 3.50% Answer: B Diff: 1 Type: MC Skill: Analytical Objective: 6.2 Compute the price and yield to maturity of a zero-coupon bond 15) A risk-free, zero-coupon bond with a face value of $1,000 has 15 years to maturity. Zero Coupon Bond Calculator - What is the Market Price ... Benefits and Drawbacks of Zero Coupon Bonds. Zero coupon bonds have a duration equal to their time until maturity, unlike bonds which pay coupons. Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more ...

Solved "A zero-coupon bond has a yield to maturity of 5% ... "A zero-coupon bond has a yield to maturity of 5% and a par value of $1000. If the bond matures in 5 years, it should sell for a price of _____ today. Zero Coupon Bond Yield: Formula, Considerations, and ... The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... Solved 15, A zero-coupon bond has a yield to maturity of 9 ... A coupon bond pays interest semi-annually, matures in five years, has a par value of $1,000,a coupon rate of 12%, and an effective annual yield to maturity; Question: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C ...

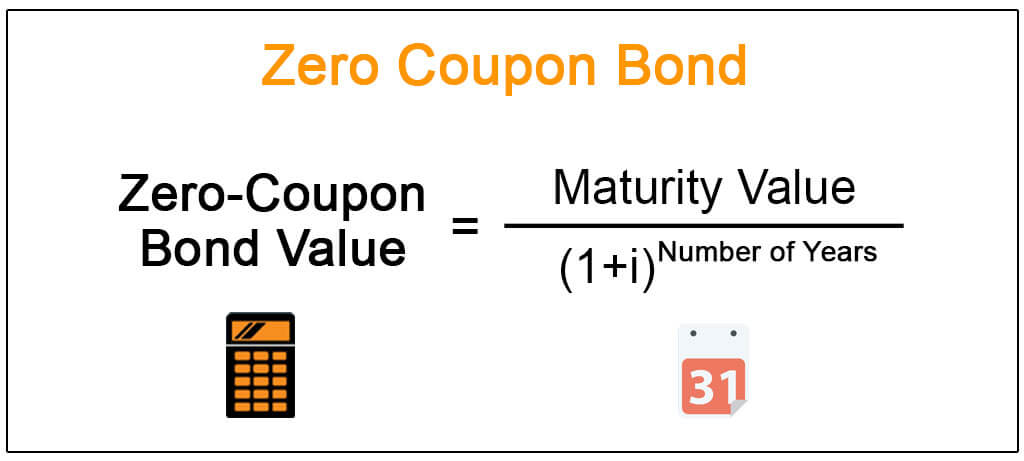

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Yield to Maturity vs. Coupon Rate: What's the Difference? Yield to Maturity (YTM) The YTM is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same...

Zero Coupon Bond - Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Value and Yield of a Zero-Coupon Bond | Formula & Example Where yield is the periodic bond yield and n refers to the total compounding periods till maturity.. Yield on a Zero-Coupon Bond. Given the current price (or issue price) of a zero-coupon bond (denoted as P), its face value (also called maturity value) of FV and total number of n coupon payments, we can find out its yield to maturity using the following equation:

How To Calculate Yield To Maturity Of Zero Coupon Bond In ... These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. The yield to maturity formula for a zero-coupon bond. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest.

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

PV and YTM of Zero-Coupon Bonds Calculator (on Google ... Example Problem:Consider the following $1,000-par-value zero-coupon bonds. What is the yield to maturity for each bond?Yield to Maturity of Zero-Coupon Bonds...

What is the difference between a zero-coupon bond and a ... A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Zero-coupon bonds are more volatile than coupon bonds, so...

How to Calculate a Zero Coupon Bond Price | Double Entry ... As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Solved You find a zero coupon bond with a par value of ... You find a zero coupon bond with a par value of $10,000 and 24 years to maturity. If the yield to maturity on this bond is 4.2 percent, what is the price of the bond? Assume semiannual compounding periods. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Yield to Maturity - YTM vs. Spot Rate. What's the Difference? Spot Rate= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 The formula for the spot rate given above only applies to zero-coupon bonds. Consider a $1,000 zero-coupon bond that has two...

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

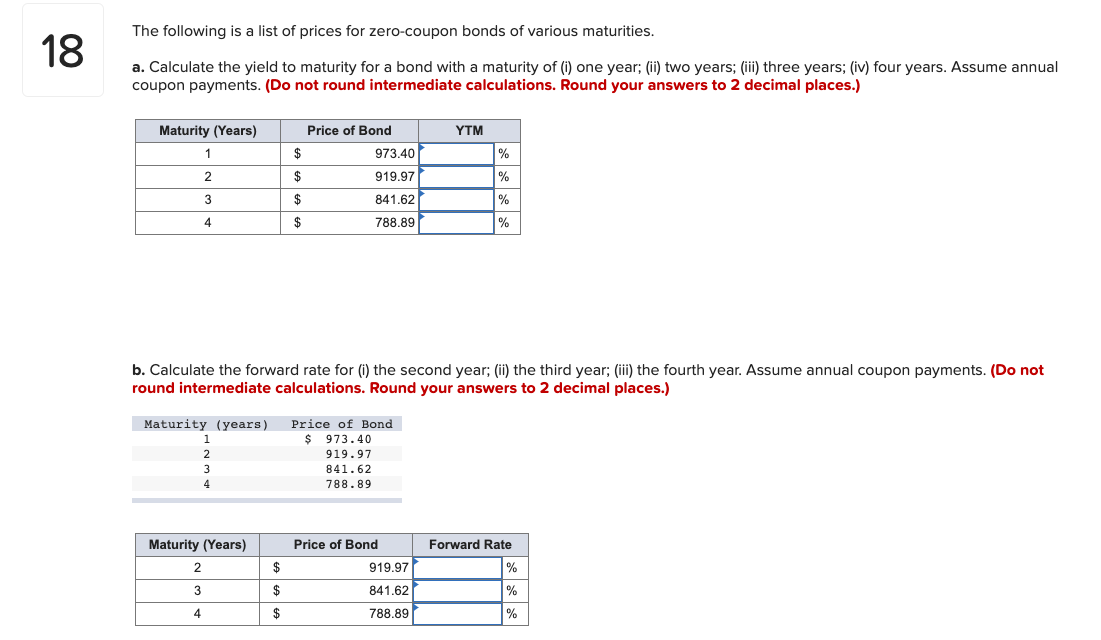

The following is a list of prices for zero-coupon bonds of various maturities. a. Calculate the ...

zeroyield - lost-contact.mit.edu In other words, if the zero-coupon computed with this yield is used to discount the reference bond, the value of that reference bond will be equal its price. Yield is a column vector containing a bond-equivalent yield for each zero-coupon instrument. When the maturity date is fewer than 182 days away and the basis is actual/365, the function ...

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to maturity formula zero ...](https://img.homeworklib.com/questions/15acd000-74b9-11ea-81d5-15b917a6a842.png?x-oss-process=image/resize,w_560)

Post a Comment for "40 yield to maturity of zero coupon bond"