43 yield to maturity for zero coupon bond

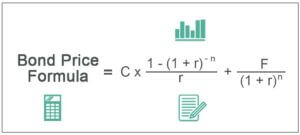

Yield To Maturity - Bond Yield Yield To Maturity - Bond Yield. Bonds are quoted based on several indicators. Price, coupon rate (nominal yield), call yield (if callable) and yield to maturity. Each of these will effect the value of the investment. The yield to maturity is the overall rate of return, over the life of the bond based on many of the factors above. Premium. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05/2) 5*2 = $781.20 The price that John will pay for the bond today is $781.20.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate.

Yield to maturity for zero coupon bond

The yield to maturity (YTM) on 1-year zero-coupon | Chegg.com The yield to maturity (YTM) on 1-year zero-coupon bonds is 5% and the YTM on 2-year zeros is 6%. The yield to maturity on 2-year-maturity coupon bonds with coupon rates of 10% (paid annually) is 5.7%. a. What arbitrage opportunity is available for an investment banking firm? Zero Coupon Bond Yield Calculator - YTM of a discount bond Zero Coupon Bond Yield Calculator. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond. How To Calculate Yield To Maturity Of Zero Coupon Bond In ... A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. The exact same formula is used to calculate both YTM and YTC Yield to Call. For the bond is 15 and the bond will reach maturity in 7 years.

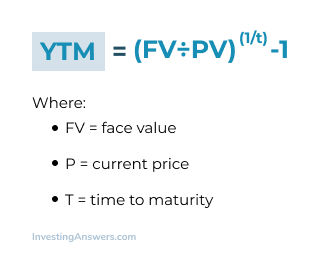

Yield to maturity for zero coupon bond. Zero Coupon Bond - Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ... Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Advantages and Risks of Zero Coupon Treasury Bonds The responsiveness of bond prices to interest rate changes increases with the term to maturity and decreases with interest payments. Thus, the most responsive bond has a long time to maturity... Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

What is the difference between a zero-coupon bond and a ... Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion.... Zero Coupon Bond Yield: Formula, Considerations, and ... The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... zeroyield - lost-contact.mit.edu In other words, if the zero-coupon computed with this yield is used to discount the reference bond, the value of that reference bond will be equal its price. Yield is a column vector containing a bond-equivalent yield for each zero-coupon instrument. When the maturity date is fewer than 182 days away and the basis is actual/365, the function ... Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving...

Yield to Maturity - YTM vs. Spot Rate. What's the Difference? The spot interest rate for a zero-coupon bond is calculated as: Spot Rate= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 The formula for the spot rate given above only applies to... Zero Coupon Bond - WallStreetMojo Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Solved 15, A zero-coupon bond has a yield to maturity of 9 ... A coupon bond pays interest semi-annually, matures in five years, has a par value of $1,000,a coupon rate of 12%, and an effective annual yield to maturity; Question: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C ...

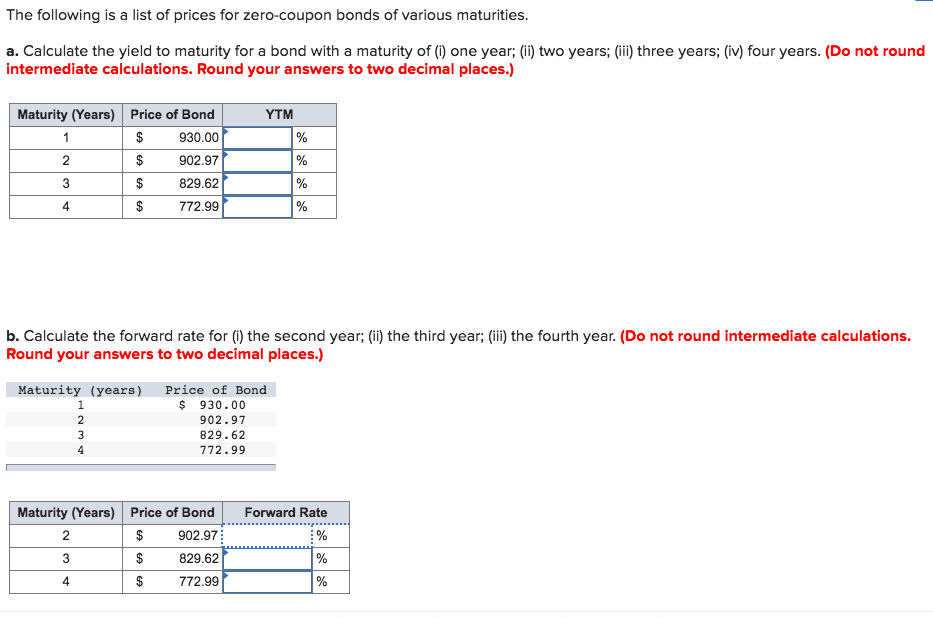

The following is a list of prices for zero-coupon bonds of various maturities. a. Calculate the ...

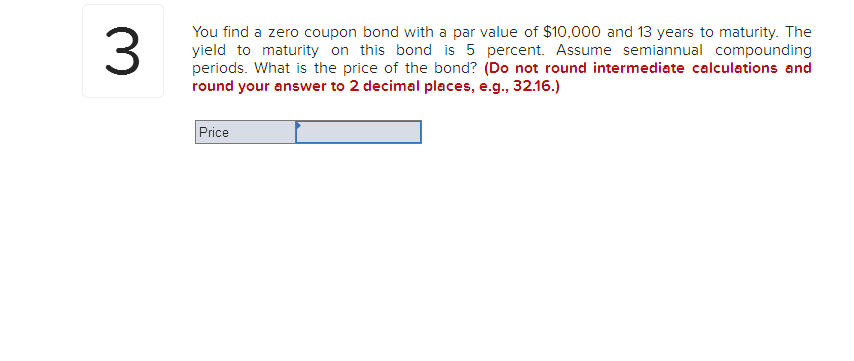

PDF Bond Par Bond By Roger Moore Gareth Owen Gérald Guétat At Maturity' 'you find a zero coupon bond with a par value of 10 000 april 24th, 2020 - question you find a zero coupon bond with a par value of 10 000 and 17 years to maturity if the yield to maturity on this bond is 4 9 percent what is the price of the bond' 'Bond Yield to Maturity YTM Calculator DQYDJ

The yield to maturity (YTM) on a 1-year zero-coupon ... The yield to maturity (YTM) on a 1-year zero-coupon bond is 5.2%, the YTM on a 2-year zero bond is 5.9%, and the YTM on a 3-year zero is 6.2%. The YTM on a 3-year maturity coupon bond with coupon rates of 11.5% (paid annually) is 6%. [Assume a face value of $1,000.] What arbitrage opportunity is available for an investment banking firm? What is the

Value and Yield of a Zero-Coupon Bond | Formula & Example = $5,317 This gain of $5,317 is made up of the unwinding of discount (the increase in present value as it nears maturity) plus capital gain portion that results from positive movement in market yield on the bond. The value of zero-coupon bond will continue to increase till it reach $100,000 at the time of its maturity.

Zero Coupon Bond Calculator - What is the Market Price ... So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

The yield to maturity (YTM) on 1-year zero-coupon | Chegg.com The yield to maturity on 2-year-maturity coupon bonds with coupon rates of 9% (paid annually) is 7.2%. a. What arbitrage opportunity is available for an investment banking firm? Question: The yield to maturity (YTM) on 1-year zero-coupon bonds is 7% and the YTM on 2-year zeros is 8%. The yield to maturity on 2-year-maturity coupon bonds with ...

Solved: The yield to maturity on 1-year zero-coupon bonds ... The yield to maturity on 1-year zero-coupon bonds is currently 7%; the YTM on 2-year zeros is 8%. The Treasury plans to issue a 2-year maturity coupon bond, paying coupons once per year with a coupon rate of 9%. The face value of the bond is $100.

How to Calculate a Zero Coupon Bond Price | Double Entry ... As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Fin 316 lecture 5 bonds.pdf - Bonds Objectives: What are ... Yield to Maturity Bond-land calls their r 's Yield to Maturity (YTM, or just yield): it is the discount rate that sets the present value of the bond payments equal to the current price of the bond. ... Zero Coupon Bonds Sometimes bonds come without coupons (coupon rate = 0%).

How To Calculate Yield To Maturity Of Zero Coupon Bond In ... A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. The exact same formula is used to calculate both YTM and YTC Yield to Call. For the bond is 15 and the bond will reach maturity in 7 years.

Zero Coupon Bond Yield Calculator - YTM of a discount bond Zero Coupon Bond Yield Calculator. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond.

The yield to maturity (YTM) on 1-year zero-coupon | Chegg.com The yield to maturity (YTM) on 1-year zero-coupon bonds is 5% and the YTM on 2-year zeros is 6%. The yield to maturity on 2-year-maturity coupon bonds with coupon rates of 10% (paid annually) is 5.7%. a. What arbitrage opportunity is available for an investment banking firm?

Post a Comment for "43 yield to maturity for zero coupon bond"