39 how to calculate zero coupon bond

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve … How to Calculate PV of a Different Bond Type With Excel 20.02.2022 · A. Zero Coupon Bonds Let's say we have a zero coupon bond (a bond which does not deliver any coupon payment during the life of the bond but sells at a discount from the par value) maturing in 20 ...

What Is a Zero-Coupon Bond? | The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 =...

How to calculate zero coupon bond

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Understanding Zero Coupon Bonds - Part One - The Balance Here is an example of how zero coupon bond prices can change: For example, assume that three STRIPS are quoted in the market at a yield of 6.50%. The price for STRIPS with 25 years remaining to maturity would be $202.07 per $1,000 face amount That for STRIPS with 10 years remaining to maturity would be $527.47 per $1,000 face amount Calculate Price of Bond using Spot Rates | CFA Level 1 27.09.2019 · Sometimes, these are also called “zero rates” and bond price or value is referred to as the “no-arbitrage value.” Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ...

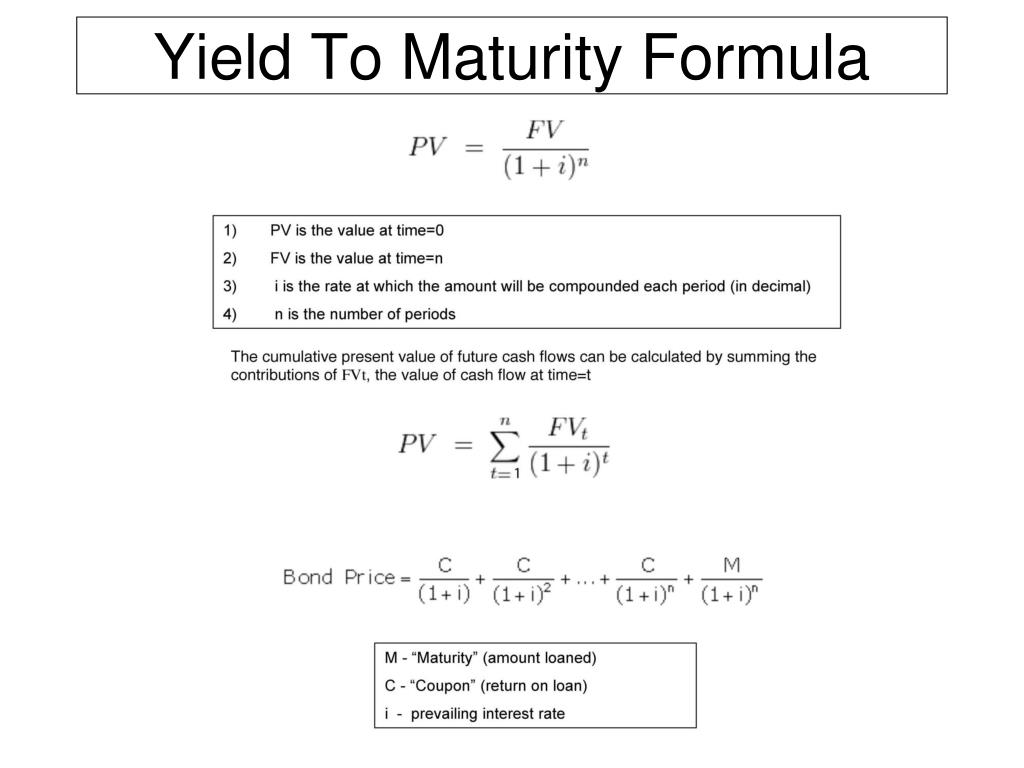

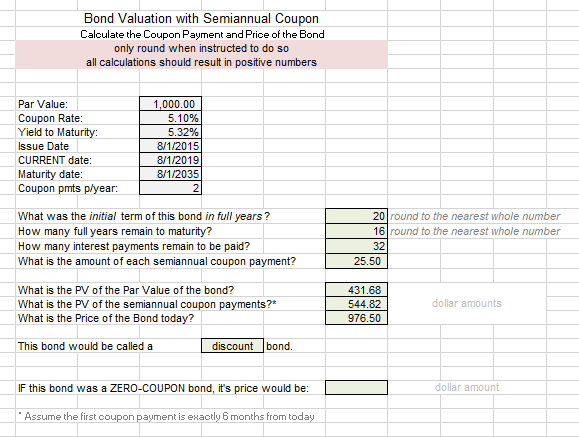

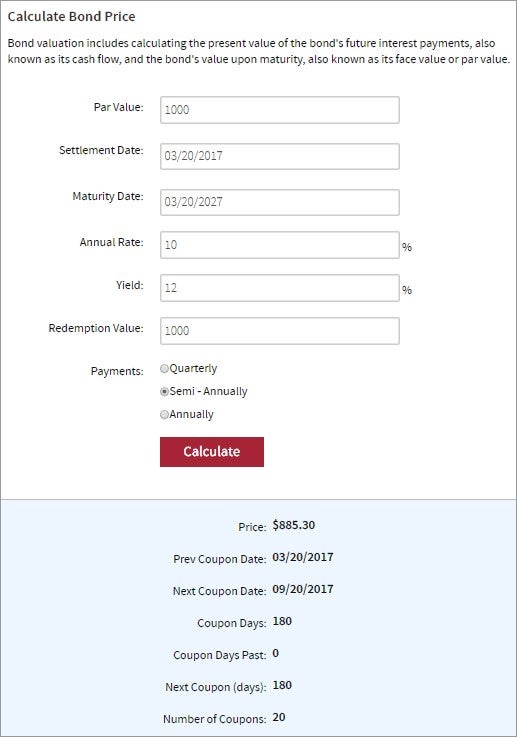

How to calculate zero coupon bond. Calculate Bond Return With This Easy Method | Shortform Books To calculate bond return for zero-coupon bonds—assuming the issuer doesn't default—the return will equal the difference between the purchase price and the face value of the bond (the face value is what you'll be paid at maturity). To calculate bond return for a coupon-paying bond, the initial yield of the bond provides a good, if not ... Zero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor ... What Is Dirty Price? - thebalance.com The dirty price is calculated as follows: 1 Dirty price = Clean price + Accrued interest You'll typically see a bond price quoted as a percentage of its face value, also known as par value. 2 For example, if Corporation ABC issues bonds with a $1,000 face value that are quoted at 97, the price of the bond is $970. How to Calculate the Price of a Bond With Semiannual Coupon … 24.04.2019 · Calculating the price of a bond with semiannual coupon payments involves some higher mathematics. Essentially, you'll have to discount future cash flows back to present values. To determine if the bond is a good value, compare the return of the bond with competitive issues in the marketplace.

How To Calculate Yield To Maturity Of Zero Coupon Bond In Excel Select the cell you will place the calculated result at type the formula PV B4B30B2 into it and press the Enter key. This makes calculating the yield to maturity of a zero coupon bond straight-forward. F represents the Face or Par Value. Insert the following function into B18. The formula for determining approximate YTM would look like below. How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Coupon Bond - Guide, Examples, How Coupon Bonds Work Nevertheless, the term "coupon" is still used, but it merely refers to the bond's nominal yield. How Does a Coupon Bond Work? Upon the issuance of the bond, a coupon rate on the bond's face value is specified. The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These ... Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). Calculating Yield to Maturity in Excel - Speck & Company There are two formulas to calculate yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [ (Face Value / Current Value) (1 / time periods)] -1. The yield to maturity formula for a coupon bond: Bond Price = [ Coupon x (1 - (1 / (1 + YTM) n) / YTM) ] + [ Face Value x (1 / (1 + YTM) n ... Zero Coupon Bond | Definition, Formula & Examples - Study.com The zero-coupon bond definition is a financial instrument that does not pay interest or payments at regular frequencies (e.g. 5% of face value yearly until maturity). Rather, zero-coupon bonds ...

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Realized Compound Yield versus Yield to Maturity - Rate Return With a reinvestment rate equal to the 10% yield to maturity, the realized compound yield equals yield to maturity. But what if the reinvestment rate is not 10%? If the coupon can be invested at more than 10%, funds will grow to more than $1,210, and the realized compound return will exceed 10%. If the reinvestment rate is less than 10%, so will ...

Zero Coupon Bond: Definition, Formula & Example - Study.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =...

fixed income - How do you construct a zero coupon curve from the ... The yields at a tenor of 0.5 years calculated above is a zero-coupon rate and your starting point for bootstrapping the zero-coupon curve. We then use bootstrapping to construct the zero/spot curve. We use the interpolated yield for each tenor as the ANNUAL COUPON which defines the cash flows before maturity.

› documents › excelHow to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown.

Calculating the cost basis on a tax free Zero Coupon Bond No accrued interest on a zero coupon bond :-) Interest rate = yield to maturity. Yield to maturity and price are inversely related, if one goes up the other goes down. Your original question was "what interest rate should I choose". What I am saying is there is no "choice" to be made.

› terms › zZero-Coupon Bond Definition - Investopedia Nov 11, 2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero Coupon Bond Calculator The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

› Zero-Coupon-BondZero Coupon Bond Yield - Formula (with Calculator) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value.

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond;

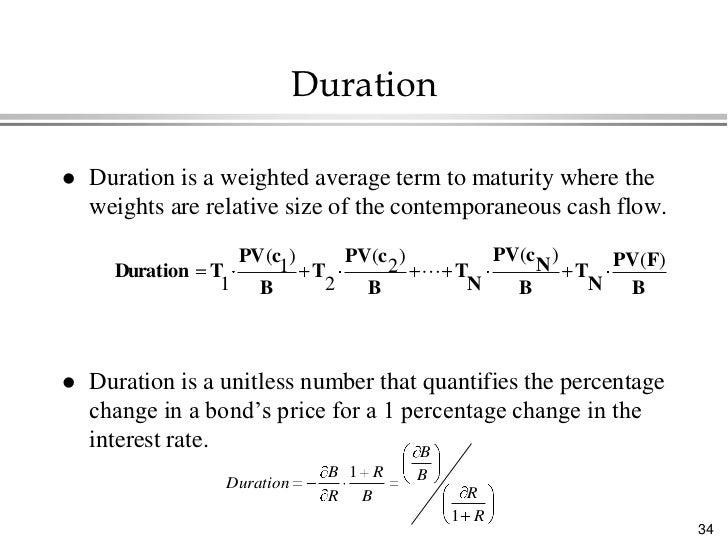

What Is Duration of a Bond? - TheStreet Definition - TheStreet The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is ...

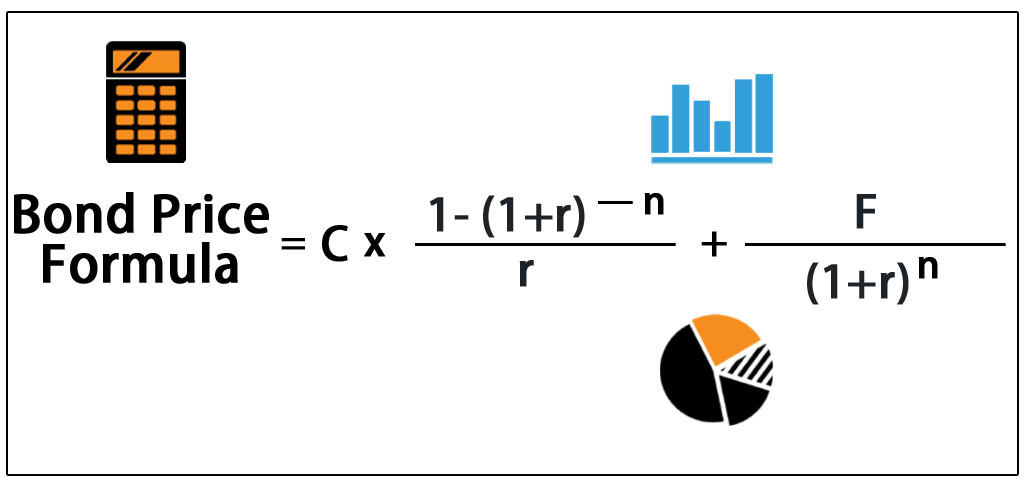

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

How to calculate spot rate for maturity which does not have a zero ... How do I calculate zero-coupon yields for a maturity which does not have an equivalent zero-coupon bond? For instance, let's say we have this spot rate curve: t0.5=1% t1=2% And a bond which has a c...

How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. You can calculate the price of …

Zero-Coupon CDs: What They Are And How They Work | Bankrate Zero-coupon CDs, in comparison, are purchased at a lower price and you receive the entire interest amount at the CD's maturity date. So with a zero-coupon CD, you wait longer to receive the ...

Bond Equivalent Yield Formula - FundsNet In order to compare the returns on these zero-coupon bonds with traditional bonds that provide an annual interest payment, an investor must use the BEY formula, which annualizes the return. BEY Example. For an example of the BEY formula in use, suppose that an investor purchases a $2,000 zero-coupon bond, which they pay $1,700 for.

Post a Comment for "39 how to calculate zero coupon bond"