43 what is bond coupon rate

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and … Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership.

Coupon Rate: Formula and Bond Nominal Yield Calculator The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders.

What is bond coupon rate

Coupon Rate - Meaning, Calculation and Importance - Scripbox The bond's coupon rate refers to the amount of annual interest the bondholder receives from the bond's issuer. Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. How to Find Coupon Rate of a Bond on Financial Calculator The coupon rate is the percentage of a bond's par value paid as interest each year. Par value is the face value of the bond, which is the amount the bondholder will receive when the bond matures. The coupon rate is determined by the issuing company when the bond is issued and remains fixed throughout the bond's life. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

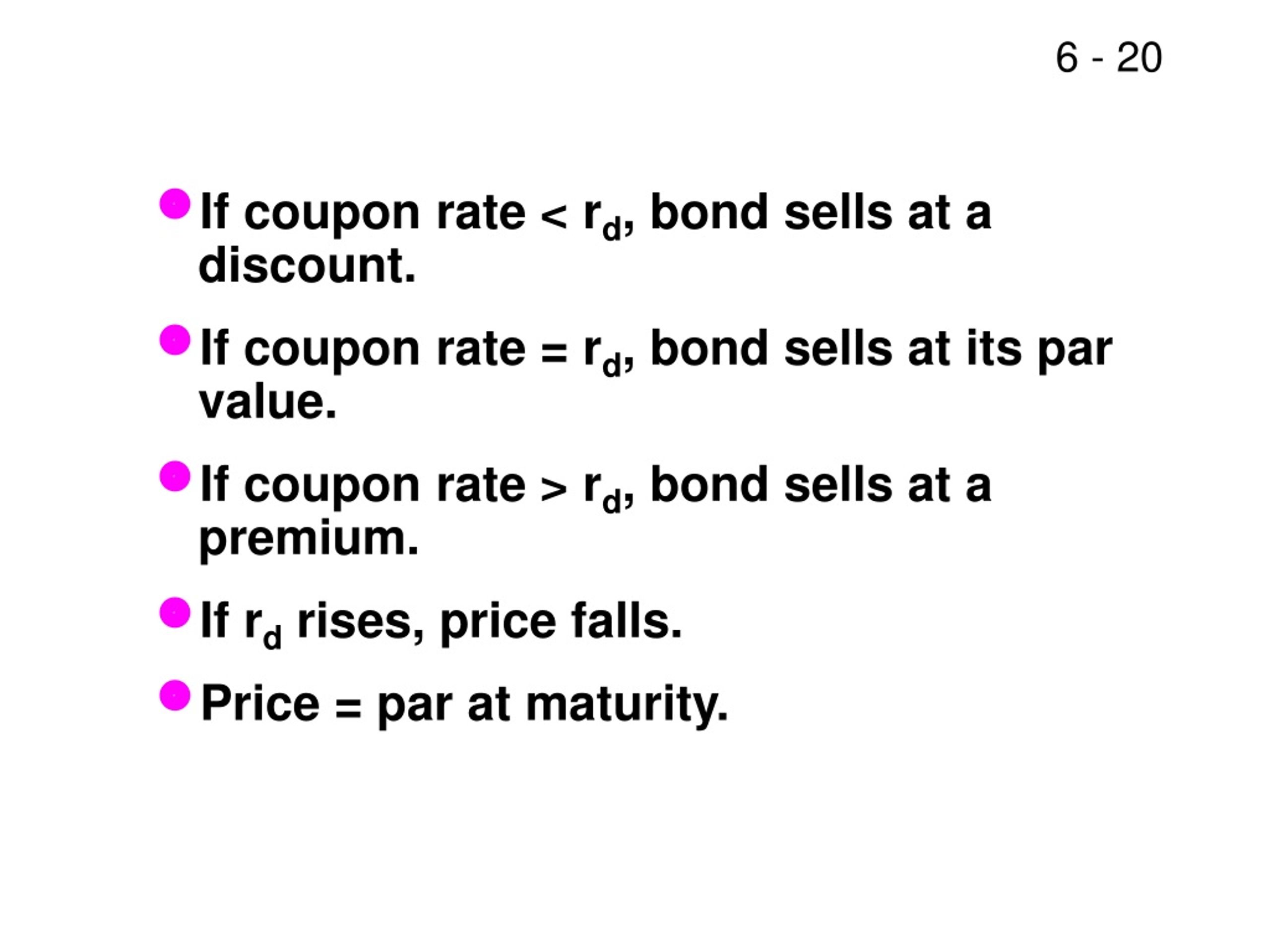

What is bond coupon rate. Bond Prices, Rates, and Yields - Fidelity While you own the bond, the prevailing interest rate rises to 7% and then falls to 3%. 1. The prevailing interest rate is the same as the bond's coupon rate. The price of the bond is 100, meaning that buyers are willing to pay you the full $20,000 for your bond. 2. Prevailing interest rates rise to 7%. Buyers can get around 7% on new bonds, so ... Difference Between Coupon Rate and Discount Rate Securities with low coupon rates will have higher Discount rate hazards than securities that have higher coupon rates. If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates etc, Please provide us with an attribution link.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms... What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ... What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

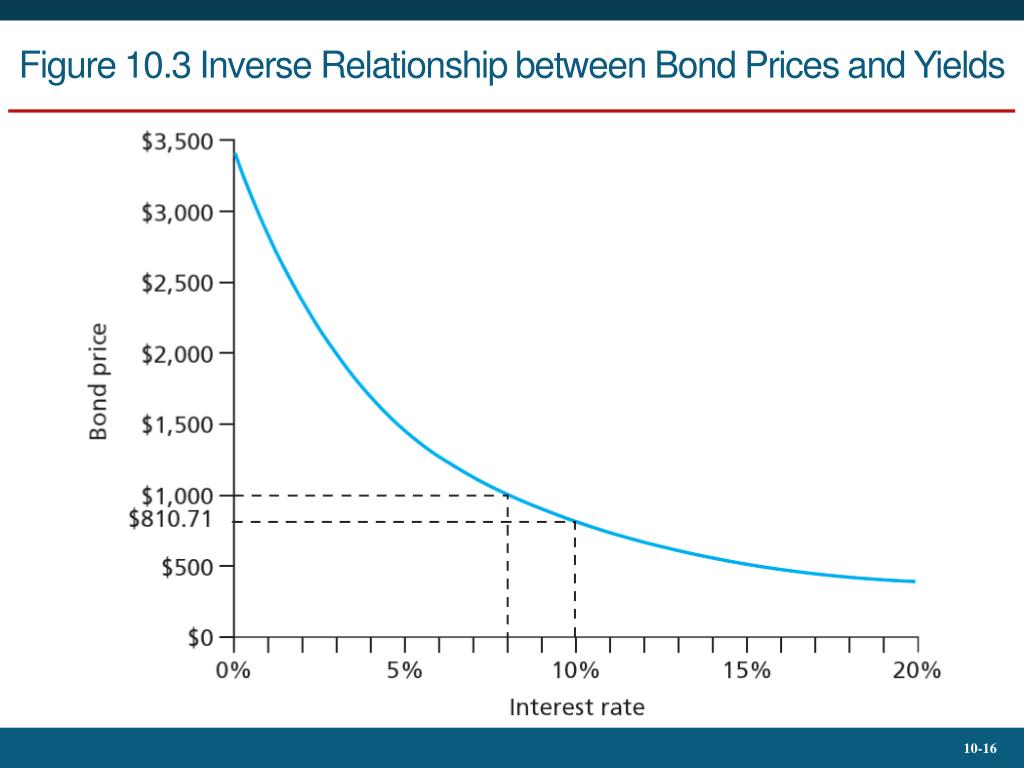

What is a Coupon Rate? | Bond Investing | Investment U Coupon rates are the static variable in a dynamic bond market. This makes them an important variable in establishing market rates. The Inverse Relationship Between Price and Yield As bond prices fluctuate and coupon rates stay the same, the yield of a bond changes. This is an extremely important consideration because it changes the value of a bond. Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond, although bonds... Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... A premium bond offers a coupon rate that is higher than the required ... A premium bond offers a coupon rate that is higher than the required rate of return, so amortization of the premium serves to lower the return to bring it in line with the market discount rate.

Series I Savings Bonds Rates & Terms: Calculating Interest Rates Series I Savings Bonds Rates & Terms: Calculating Interest Rates. NEWS: The initial interest rate on new Series I savings bonds is 9.62 percent. You can buy I bonds at that rate through October 2022. Learn more.. KEY FACTS: I Bonds can be purchased through October 2022 at the current rate. That rate is applied to the 6 months after the purchase is made.

How To Determine Coupon Rate On A Bond - khaodara.info Just picked up 6 packs 2 per pack of Hubbelite XPR bulbs 3. That is pretty how to determine coupon rate on a bond impossible in a restaurant that is open so many hours. not the easiest solution! The products we sell are sourced from a variety of international suppliers with China as a significant source. More Big savings for you with NTB best ...

Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

Post a Comment for "43 what is bond coupon rate"