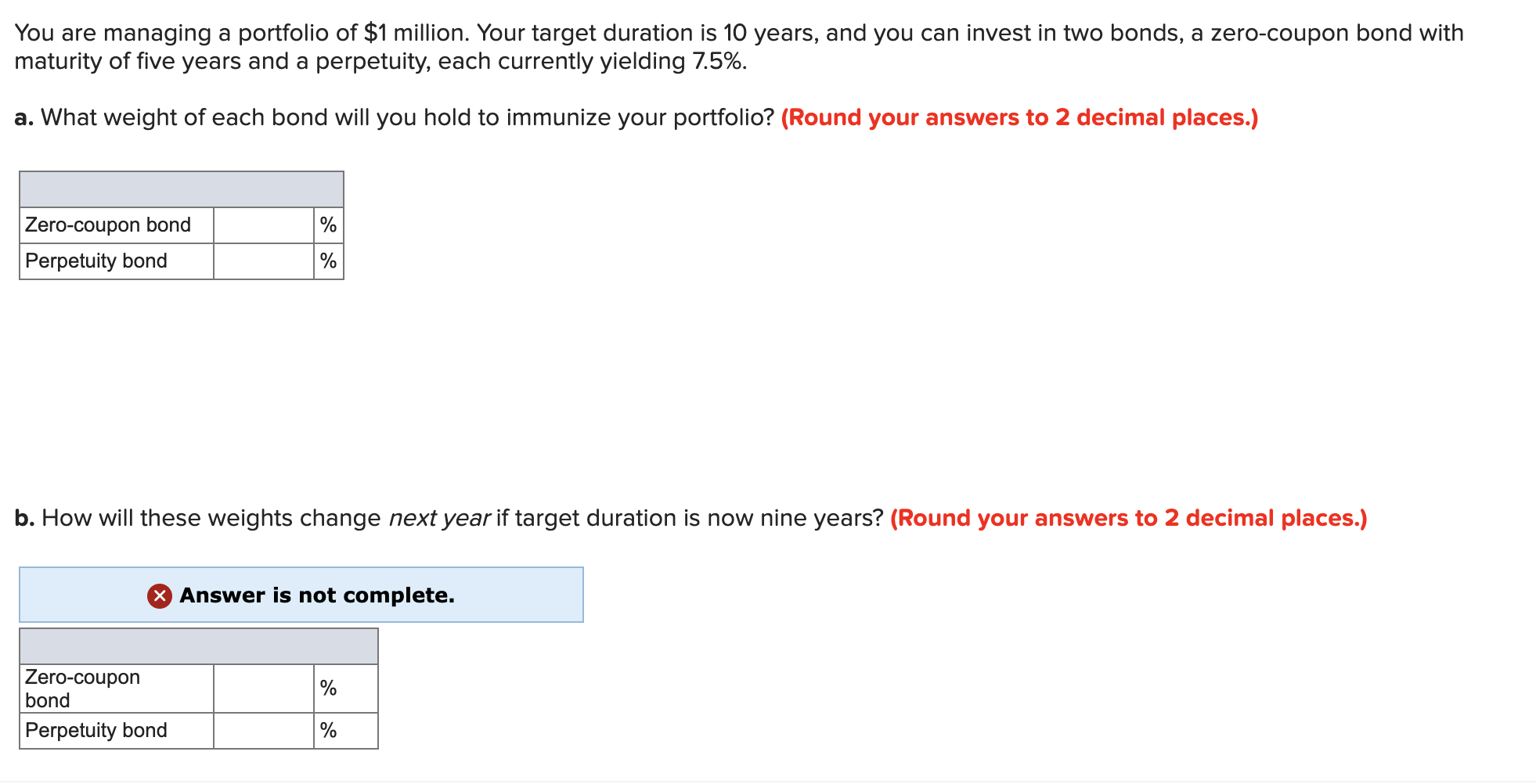

44 duration for zero coupon bond

Zero Coupon Bond Modified Duration Formula - Bionic Turtle We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%. › zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

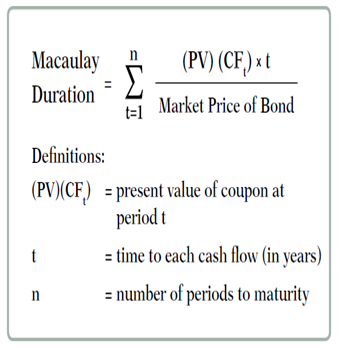

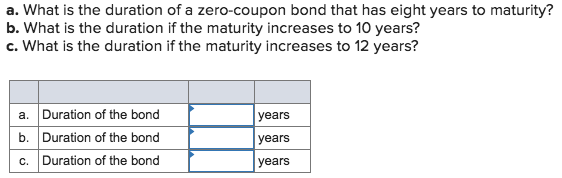

duration of zero coupon bonds | Forum | Bionic Turtle The Macaulay duration of a zero-coupon bond equals its maturity, such that the Mac duration of a zero-coupon bond must be monotonically increasing, and. DV01 = Price * Mod duration /10000, where in the case of a zero coupon bond: Price is a decreasing function of maturity (i.e., a zero is acutely "pulled to par"), but Mod duration is an ...

Duration for zero coupon bond

Zero coupon bond interest rate - kmjhar.ducati-scrambler.de Bond Yields Canadian Overnight Repo Rate Average View or download the latest data for CORRA, Canada's risk-free rate . Yield Curves for Zero-Coupon Bonds Yields on zero-coupon bonds , generated using pricing data on Government of Canada bonds and treasury bills. Money Market Yields. › dictionary › dWhat Is Duration of a Bond? - TheStreet Definition - TheStreet Oct 03, 2022 · The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is ... calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified ...

Duration for zero coupon bond. › terms › dDuration Definition and Its Use in Fixed Income Investing Sep 01, 2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds may not reach maturity for decades, so it is essential to buy bonds from creditworthy entities. Some of them are issued with provisions that permit them to be paid out ( called)... The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and... What Is Bond Duration? Definition, Formula & Examples What Is Bond Duration? Definition, Formula & Examples TheStreet Staff; Oct 3, 2022 Oct 3, 2022 Updated 19 hrs ago; Facebook ... Zero-coupon Bond; Maturity Date; Value; Price; Investment;

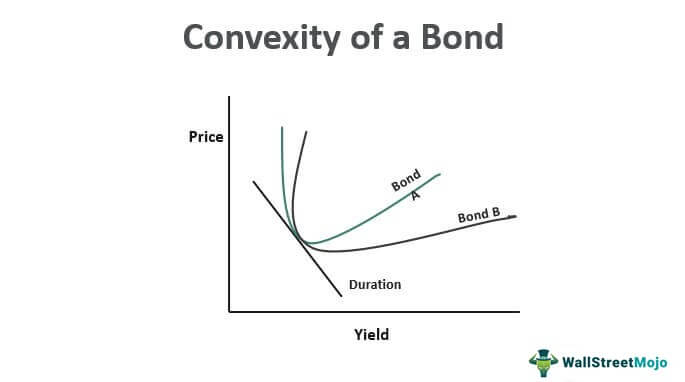

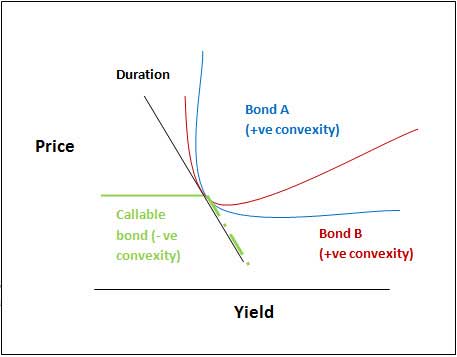

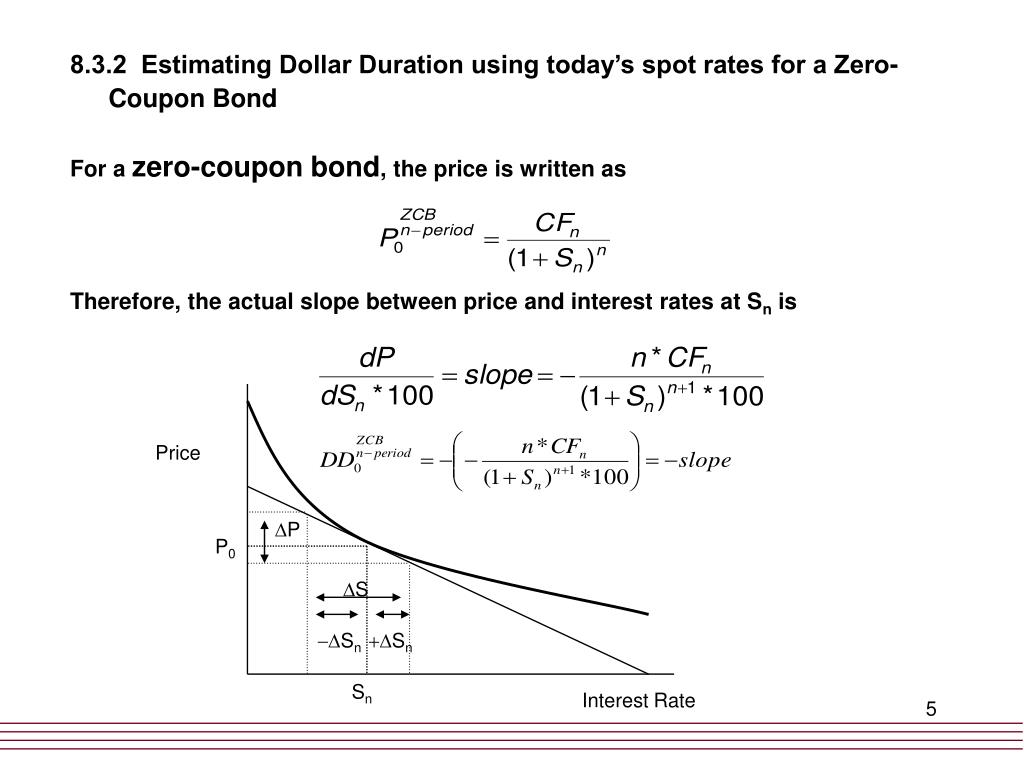

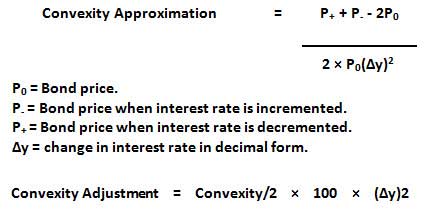

› articles › bondsDuration and Convexity to Measure Bond Risk - Investopedia Jun 22, 2022 · The duration of a zero-coupon bond equals time to maturity. Holding maturity constant, a bond's duration is lower when the coupon rate is higher, because of the impact of early higher coupon payments. Zero-coupon bond - Wikipedia Zero coupon bonds may be long or short-term investments. Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills. Zero-Coupon Bond Primer: What are Zero-Coupon Bonds? - Wall Street Prep If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding periods (t). Formula Price of Bond (PV) = FV / (1 + r) ^ t Where: PV = Present Value FV = Future Value r = Yield-to-Maturity (YTM) t = Number of Compounding Periods › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

What is the duration of a zero coupon bond? - Quora Originally Answered: what is the duration of a zero coupon bond? Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. Zero coupon bond interest rate - uapoq.magicears.shop That time the company issue a bond at a deep discount, which is without any interest and also called as Zero-coupon bond . It is called a Deep Discount bond or Zero Coupon Bond . The difference between the Maturity amount received and the purchase price is an Income to this type of Bondholder. Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

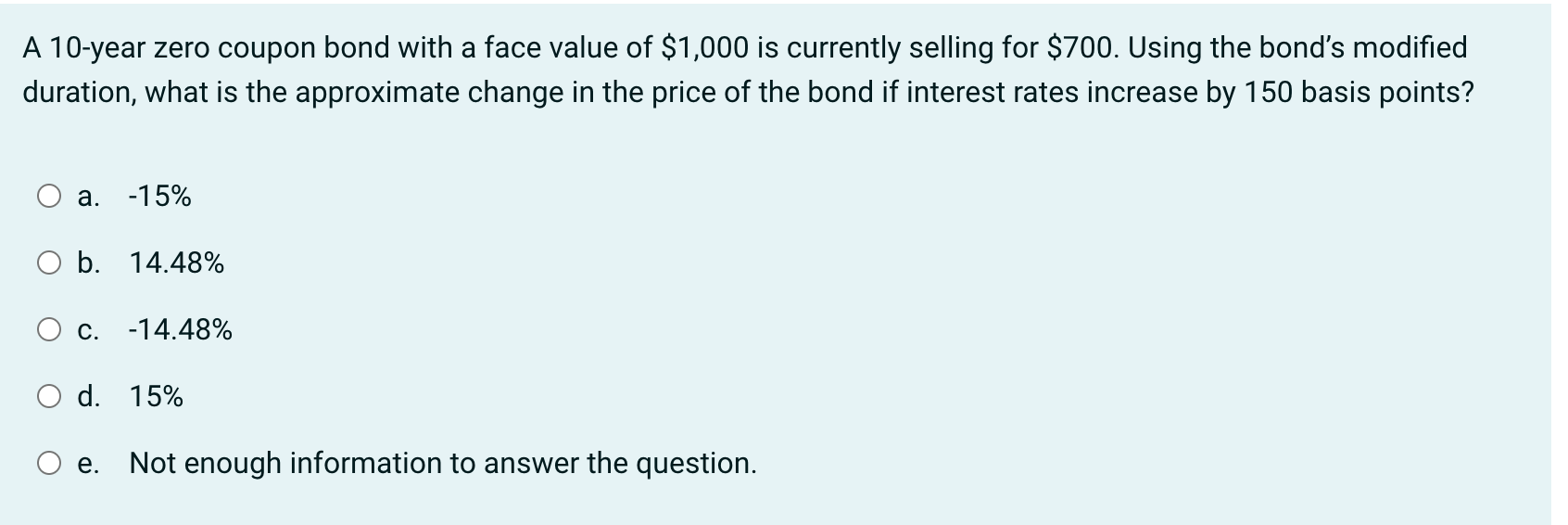

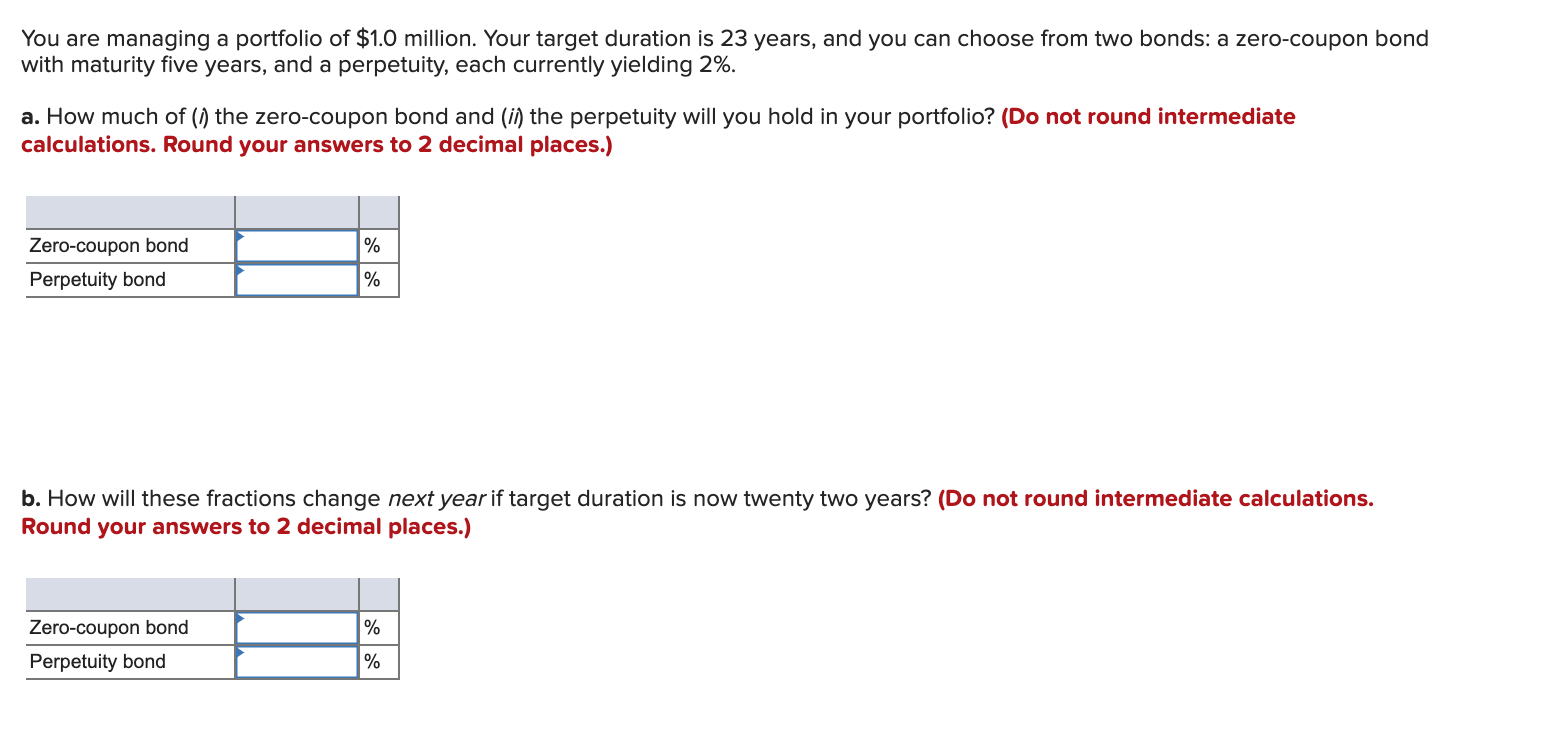

Dollar Duration - Overview, Bond Risks, and Formulas Dollar duration can be applied to any fixed income products, including forwarding contracts, zero-coupon bonds, etc. Therefore, it can also be used to calculate the risk associated with such products. Summary Dollar duration is the measure of the change in the price of a bond for every 100 bps (basis points) of change in interest rates.

Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity - it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ...

Modified duration of zero-coupond bond (FRM practice question) A zero-coupon bond with maturity of ten (10) years has a 6% bond-equivalent yield (semi-annual compounding). What is the bond's modified duration?

en.wikipedia.org › wiki › Bond_durationBond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond. Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

Macaulay Duration - Overview, How To Calculate, Factors A zero-coupon bond assumes the highest Macaulay duration compared with coupon bonds, assuming other features are the same. It is equal to the maturity for a zero-coupon bond and is less than the maturity for coupon bonds. Macaulay duration also demonstrates an inverse relationship with yield to maturity.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified ...

› dictionary › dWhat Is Duration of a Bond? - TheStreet Definition - TheStreet Oct 03, 2022 · The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is ...

Zero coupon bond interest rate - kmjhar.ducati-scrambler.de Bond Yields Canadian Overnight Repo Rate Average View or download the latest data for CORRA, Canada's risk-free rate . Yield Curves for Zero-Coupon Bonds Yields on zero-coupon bonds , generated using pricing data on Government of Canada bonds and treasury bills. Money Market Yields.

:max_bytes(150000):strip_icc()/dotdash_Final_Duration_Aug_2020-02-a79edb63b9264dc9a76ee587240a27ea.jpg)

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/13-Figure5-1.png)

Post a Comment for "44 duration for zero coupon bond"